Credit Algorithm Technology Integration

Application Deadline

Project start

Project end

To facilitate integration of the EduFinance credit algorithm with financial institution partners who have already been onboarded to the Web Application.

The EduFinance credit algorithm provides financial institutions an additional tool to inform credit approval decisions, identifying the likelihood of repayment and reducing risk. Ultimately, the credit algorithm is expected to increase FIs’ willingness to grow lending to low-fee schools, parents and students while maintaining a high-quality portfolio.

• User-friendly, step-by-step manual to integrate the existing platform that can be followed by other financial institutions to connect to the application

• Report on the skill set of the financial institution and where there are gaps/strengths

Opportunity EduFinance Director of Operations will provide background on work that has already been conducted in this area. There is already extensive documentation detailing the workings of the algorithm, a GitHub repository and staff on board with experience in how to operate the algorithm. Applicant may be required to sign a non-disclosure agreement.

Milestones

Review credit algorithm and loan products

Review and fully understand the EduFinance credit algorithm for all three products (Individual School Fee Loans, Group School Fee Loans, School Improvement Loans), including backend & end user perspective, with guidance from the Operations Director

integration

- Map expected integration steps in preparation for integration process

- Integrate at least one financial institution with the EduFinance credit algorithm

Train and revise

- Train the financial institution’s IT department to ensure that they are well equipped to use the platform

- Based on integration experience and revision of initially planned steps, create a manual for other financial institution (FI) partners to follow that can facilitate/ ease the integration process with the EduFinance web-based application

Integration Preparation

Learn partner Financial Institution banking system requirements and map expected integration steps in preparation for integration process. Understanding of APIs, data calling their integration into an IT system are crucial to being able to complete this job remotely.

Skills

Must have

Nice to have

Languages

Must have

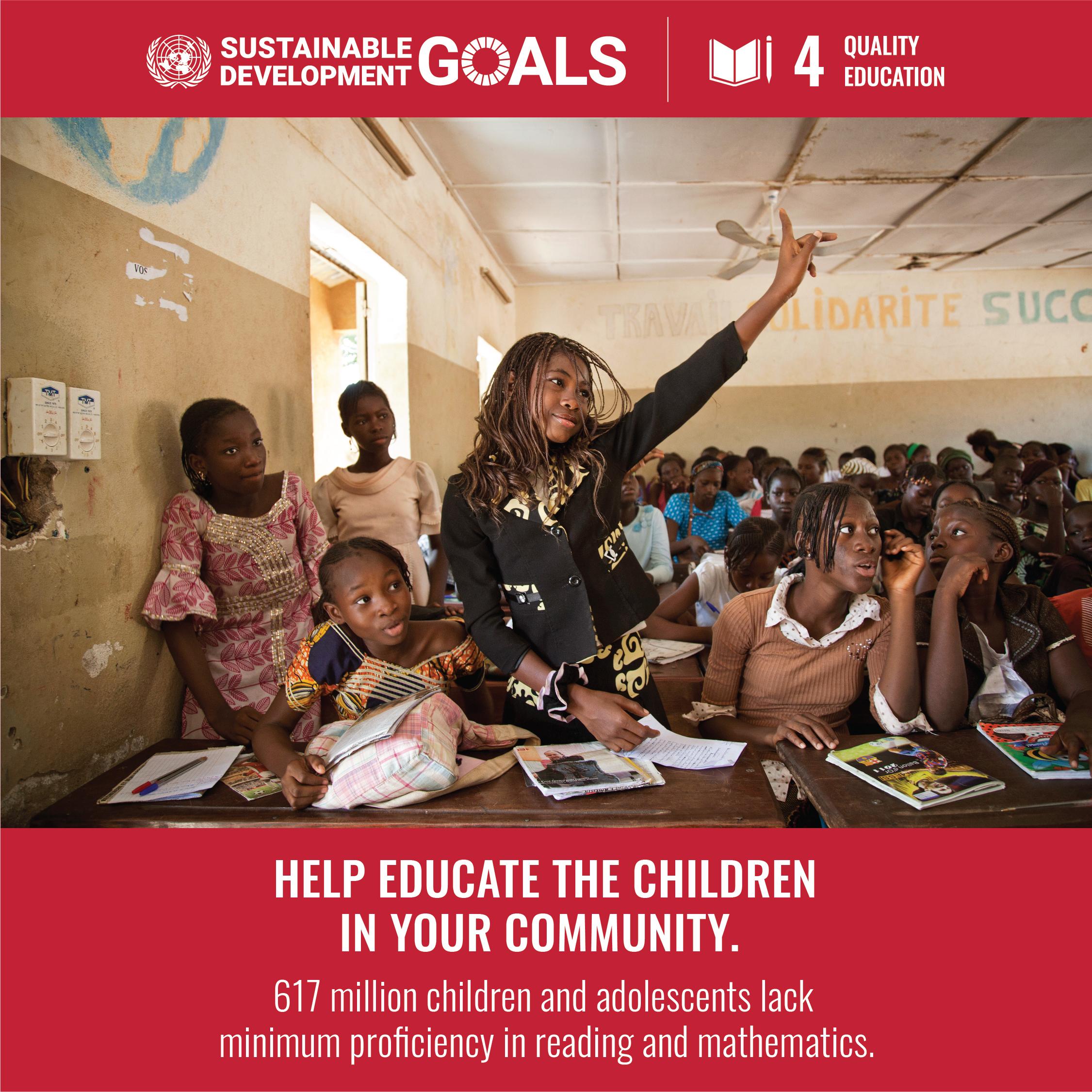

UN SDGs supported

Opportunity International

By providing financial solutions and training, we empower people living in poverty to transform their lives, their children’s futures and their communities.