Credit Algorithm Technology Integration

Anmeldeschluss

Projektstart

Projekt Ende

To facilitate integration of the EduFinance credit algorithm with financial institution partners who have already been onboarded to the Web Application.

The EduFinance credit algorithm provides financial institutions an additional tool to inform credit approval decisions, identifying the likelihood of repayment and reducing risk. Ultimately, the credit algorithm is expected to increase FIs’ willingness to grow lending to low-fee schools, parents and students while maintaining a high-quality portfolio.

• User-friendly, step-by-step manual to integrate the existing platform that can be followed by other financial institutions to connect to the application

• Report on the skill set of the financial institution and where there are gaps/strengths

Opportunity EduFinance Director of Operations will provide background on work that has already been conducted in this area. There is already extensive documentation detailing the workings of the algorithm, a GitHub repository and staff on board with experience in how to operate the algorithm. Applicant may be required to sign a non-disclosure agreement.

Meilensteine

Kreditalgorithmus und Kreditprodukte überprüfen

Überprüfen und verstehen Sie den EduFinance-Kreditalgorithmus für alle drei Produkte (individuelle Schulgeldkredite, Gruppenschulgeldkredite, Schulverbesserungskredite) vollständig, einschließlich der Backend- und Endbenutzerperspektive, unter Anleitung des Betriebsleiters.

Integration

- Planen Sie die erwarteten Integrationsschritte zur Vorbereitung des Integrationsprozesses

- Integrieren Sie mindestens ein Finanzinstitut in den EduFinance-Kreditalgorithmus

Trainieren und wiederholen

- Schulung der IT-Abteilung des Finanzinstituts, um sicherzustellen, dass sie für die Nutzung der Plattform gut gerüstet ist

- Erstellen Sie auf der Grundlage der Integrationserfahrungen und der Überarbeitung der ursprünglich geplanten Schritte ein Handbuch für andere Partnerfinanzinstitute (FI), das den Integrationsprozess mit der webbasierten Anwendung EduFinance erleichtern kann.

Vorbereitung der Integration

Lernen Sie die Anforderungen des Bankensystems des Partner-Finanzinstituts kennen und planen Sie die erwarteten Integrationsschritte zur Vorbereitung des Integrationsprozesses. Das Verständnis von APIs und Datenabrufen sowie deren Integration in ein IT-System sind entscheidend, um diese Aufgabe aus der Ferne erledigen zu können.

Fertigkeiten

Muss haben

Schön zu haben

Sprachen

Muss haben

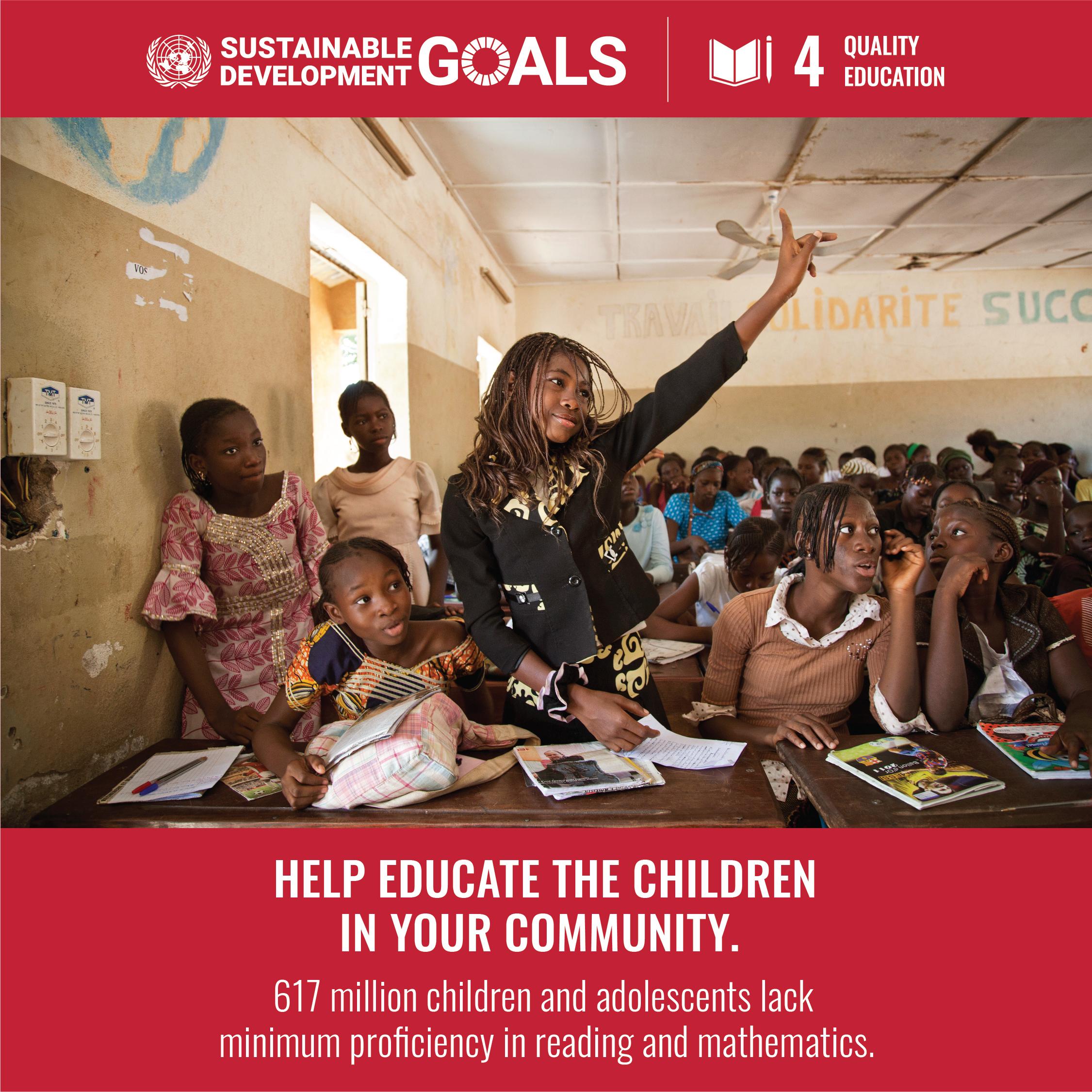

UN SDGs unterstützt

Opportunity International

By providing financial solutions and training, we empower people living in poverty to transform their lives, their children’s futures and their communities.